By: ADMIN |

2023-11-08 14:01:44

Emerging markets have experienced some of the worst scarring from the pandemic, resulting in lower growth than had been projected. China, which gets half its oil imports from the Persian Gulf, is struggling with a collapse in the real estate market and its weakest growth in nearly three decades. Tensions between the United States and China over technology transfers and security only complicate efforts to work together. And now we are facing two wars.

Israel is an American Proxy. Hamas and Hezbollah represent Iran, which in effect is a proxy of Russia and China. Missteps, poor communication and misunderstandings, could push countries to escalate even if they didn’t want to.

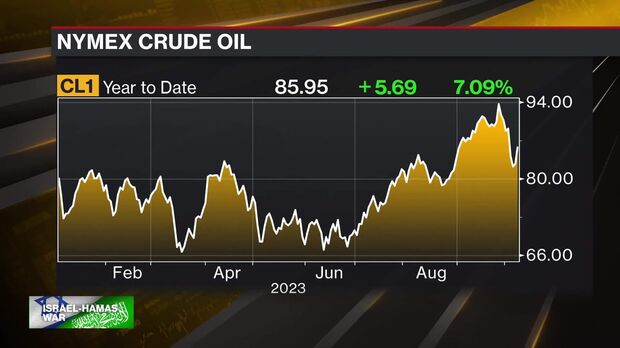

Middle-East contains 48 per cent of global proved reserves and produced 33 per cent of the world’s oil. A fifth of world oil supply passed through the Strait of Hormuz. This is the chokepoint of global energy supplies. So far, the effects on oil prices of the war in Gaza have been modest. But his war could expand. Post-pandemic recovery had just started, and now we are faced with two wars. Every $10 rise in oil reduces growth by 0.1% and increases inflation by 0.2%. If the war broadened, oil prices spike, from about $85 currently - to $150 a barrel.